The IQF (Individually Quick Frozen) industry is a sector of the frozen food industry that specializes in producing frozen fruits, vegetables, and other food products that are rapidly frozen at extremely low temperatures to preserve their texture, taste, and nutritional value. There are several methods of commercial freezing. However, each freezing method has its advantages and disadvantages. A few freezing methods are Air blast freezing, cryogenic freezing, Immersion freezing, and Individual Quick freezing.

What is IQF?

Before delving into the Indian IQF industry, Let us understand what IQF means. IQF stands for Individual Quick Freezing. This method involves each piece of fruit and vegetable being frozen separately without allowing them to stick together. This is achieved by a blast freezer, which freezes the fruits and vegetable chunks at extremely low temperatures (typically below -30 degrees Celsius) in a few seconds. For instance, below is a picture of frozen peas. Each piece of the vegetable is frozen individually and doesn’t cohere. The final product is not a single block and will be used as separate pieces.

Why is IQF the best freezing method?

Preserves quality: The IQF freezing method freezes each piece of the food separately, preventing the formation of ice crystals and preserving the texture and taste of the product.

Enhances convenience: IQF products can be quickly and easily thawed, making them a convenient option for processors and end customers.

Longer shelf life: IQF products have a longer shelf life than traditionally frozen products due to preserving the product’s quality during freezing.

Customizable: The IQF method is highly customizable, allowing food producers to freeze products in specific sizes, shapes, and quantities to meet their customer’s needs.

IQF technology plays an essential role in the frozen food industry in India. This modern technology allows frozen fruits and vegetables in India without compromising the quality, texture, and flavor. The IQF process preserves the nutritional value of fruits and vegetables, making it an attractive option for domestic and international customers.

The growth of the Indian IQF industry

The frozen food industry in India has been experiencing tremendous growth due to the increasing demand for frozen fruits and vegetables in domestic and international markets. As per the reports from APEDA, India is the second-largest producer of fruits and vegetables. India’s frozen food processing industry is the most promising and growing sector. The demand for frozen fruits and vegetables produced in India has steadily increased over the past few years due to the longer shelf life, health benefits, and year-round availability.

According to the National Horticulture Board, India produced 102.48 million tons of fruits and 200.45 million tons of vegetables during 2020-2021. Fruit cultivation covered 9.6 million hectares, while vegetables covered 10.86 million hectares.

According to FAO, India is the largest producer of mangoes, papayas, guavas, bananas, and mangosteen. Concerning Vegetables, India is leading in the production of potatoes, onions, tomatoes, and okra. Based on fruit, frozen mango, frozen pineapple, and frozen banana in slices or dice are expected to grow significantly in the next ten years. Concerning the end-user segment, the frozen food industry in India is expected to witness a CAGR of 5.3% during the forecast period (2021-2026), as per the reports by Mordor intelligence.

The demand for Indian IQF products globally

The Indian IQF market can be segmented into B2B and B2C. In B2C, the products are sold as retail packaging directly to the consumers. However, the B2B market dominates the IQF market and will continue to dominate for the next 10-15 years. As per the data bridge market research report, The individual quick freeze (IQF) fruits market was valued at USD 3.52 billion in 2021 and is projected to reach USD 5.91 billion with a CAGR of 6.70% from 2022 to 2029. The report also indicates that the increasing popularity of tropical fruits and vegetables is the key factor driving India’s frozen food processing industry.

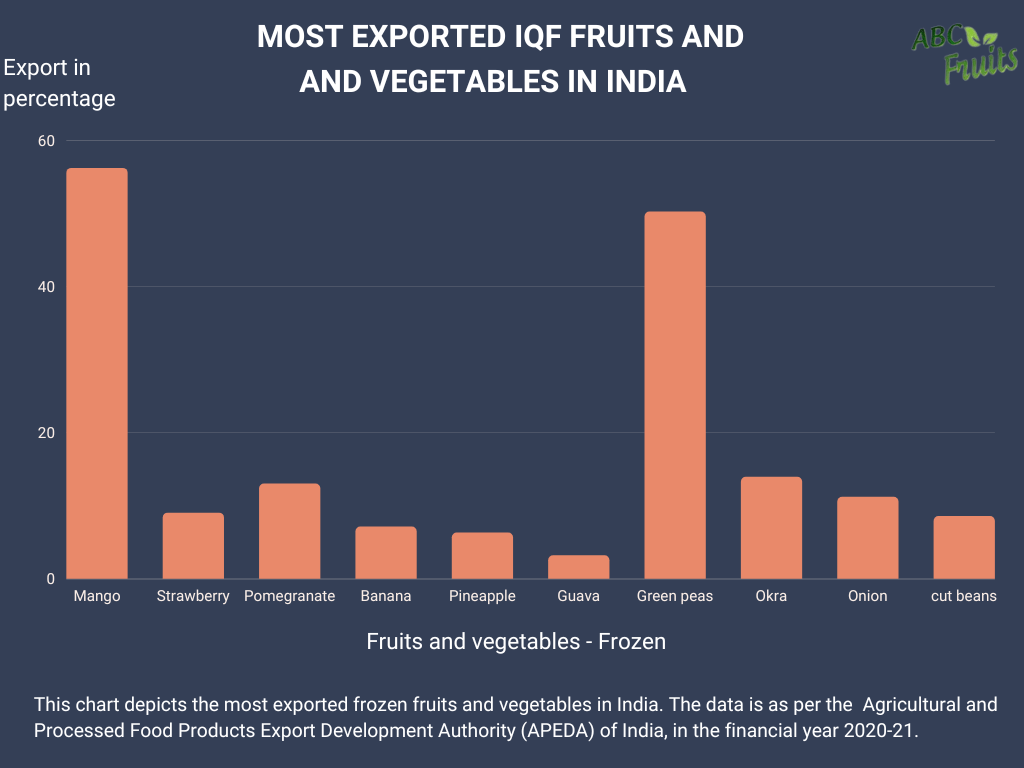

As India contributes to 50% of the world’s total mango production, mango is the most produced IQF fruit, followed by pineapple and papayas. Concerning vegetables, green peas, okra, and sweet corn are the most produced IQF vegetables. Indian processors primarily produce a few frozen fruits such as IQF mango, IQF Papaya, IQF guava, IQF pineapple, IQF muskmelon, and other frozen vegetables. These products are exported to various countries from India. India exports most frozen fruits to Australia, The United States, and Canada.

Similarly, India’s frozen vegetable exports are also in high demand in Europe and Northern America. The need for frozen fruits and vegetables is increasing due to the quality of the products and the competitive pricing. Frozen food processing industries in India can offer better competitive prices than other countries, making them a preferred supplier worldwide.

Key growth drivers for the Indian IQF industry

Globalization and availability: In response to globalization, the frozen fruit market has seen a significant increase in demand, with consumers having access to a wider variety of fruits worldwide. The IQF process and technology increase the shelf life and keep the product available for two years if stored properly. A consistent supply of frozen fruits and vegetables is available throughout the year, regardless of the season.

Increasing consumption of frozen food: With changing lifestyles and busier schedules, frozen food is becoming more popular. The increased consumption has prompted frozen food processing industries to develop and expand their products and various healthy alternatives. The products are used in processed industries like beverages, confectioneries, dairy, and baby foods.

Demand for natural and organic food is increasing: As consumers become more conscious of health and environmental benefits, demand for organic frozen fruits is increasing. Organic fruits are grown without synthetic pesticides and are perceived to be a healthier alternative. The IQF freezing process also helps to keep the fruit’s natural flavor, color, and nutrients, making it a desirable choice for those seeking natural and organic food.

IQF fruits and vegetables – Regional growth and market opportunities

The frozen food processing industry is classified into four regions: North America, Europe, Asia-pacific, and LAMEA. Concerning the IQF market opportunities, North America dominates the market with the highest possibilities. Europe grabs the second spot. Economic stability, technological advancements, and nutritional benefits are the primary reasons. In addition, the restrictions imposed by the FDA to decrease the use of trans-fat also play a significant role.

As per the reports, the Asia-pacific region and Europe is expected to grow at a CAGR of 8.3% and 7.2%, respectively, in the forecast period of (2021-2031). China has the largest IQF fruits and vegetables market share, while India is the fastest-growing Asian-Pacific market.

Challenges for IQF processors:

Quality control: The IQF process requires careful temperature, airflow, and humidity control. Any deviations from the ideal conditions can result in poor product quality and negatively impact the brand name and the industry.

Supply chain: The IQF industry relies heavily on complex supply chain systems. Any disruption in the supply chain, such as transportation delays, can impact the Indian IQF industry’s operations and profitability.

Food Safety: The IQF process must comply with certain regulations and standards. The microbial load should be in control. The processors must invest in food safety measures to prevent microbial contamination. This might increase the cost of the product.

Storage cost: Frozen fruits and vegetables temperature-controlled storage to maintain the product quality. This is viable only for processors who process in large quantities, as the cost of investing in storage facilities is high.

Conclusion:

The demand for Indian IQF products in the global market is rising due to the abundance of production, health consciousness, and competitive pricing. The Indian IQF industry is expected to grow in the coming years, providing the opportunity for frozen food marketing industries in India to contribute to the country’s economic growth. With the rising demand for ready-to-eat food products, the Indian IQF industry is poised to make significant gains in the global market.

Comments (2)

Jyoti

What could be the cost of starting a iqf manufacturing unit?

Tejas Pillai

Hi, Nice reading this. Can you update me with the latest IQF processing Units running in India currently.